Everything posted by PrettyDeadThings

-

BELLAZON CUP OF NATIONS VI

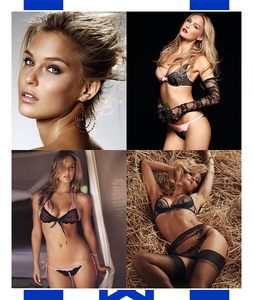

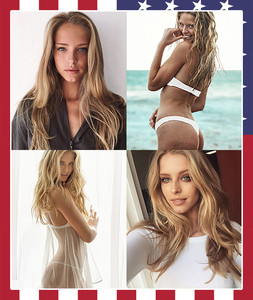

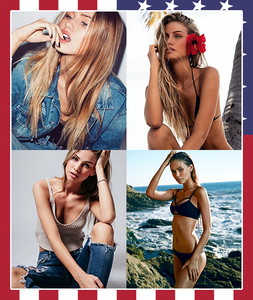

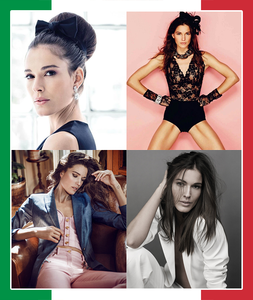

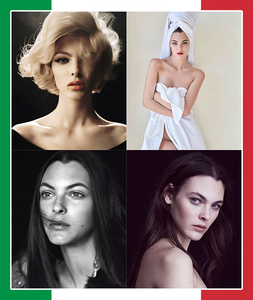

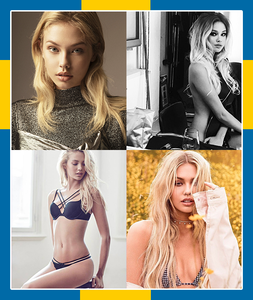

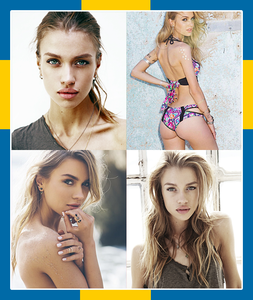

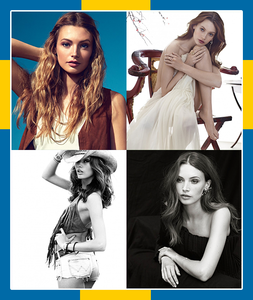

ELIMINATION ROUND *5* Click pictures for larger ROUND 5 Italy 1 / Russia 2 A - Bianca Balti - vs. - C - Sasha Luss B - Chiara Baschetti - vs. - C - Kristina Romanova C - Vittoria Ceretti - vs. - C - Valery Kaufman <-------------------------------------------> ROUND 6 USA 21 / Sweden 3 C - Bryden Jenkins - vs. - C - Kelly Gale C - Abby Champion - vs. - C - Caroline Winberg C - Scarlett Leithold - vs. - C - Emmy Rappe <-------------------------------------------> ROUND 7 Germany 1 / Israel 2 C - Bella Oelmann - vs. - C - Shiloh Malka B - Lorena Rae - vs. - B - Esti Ginzburg C - Juli Mery - vs. - C - Sofia Mechetner <-------------------------------------------> ROUND 8 Israel 1 / Ukraine 2 A - Bar Refaeli - vs. - C - Yara Khmidan C - Neta Alchimister - vs. - C - Alina Kirchiu C - Yael Shelbia - vs. - C - Daria Vlasova Voting You have 3 points to spend per pairing. The team with the most points after any bonuses or handicaps moves on or goes into the Rep round. You may vote based on whatever criteria you want Maybe you hate the majority of the team but still want them to win because you like one model on the team - go for it Perhaps you don't know who the model is but find them attractive - that's fine too Lesser of two evils - IE. The Limer voter - have at it. Maybe you're just a super fan of a particular model - ect... Voting Template [Cut & Paste] Italy vs. Russia Bianca Balti vs. Sasha Luss Chiara Baschetti vs. Kristina Romanova Vittoria Ceretti vs. Valery Kaufman USA vs. Sweden Bryden Jenkins vs. Kelly Gale Abby Champion vs. Caroline Winberg Scarlett Leithold vs. Emmy Rappe Germany vs. Israel Bella Oelmann vs. Shiloh Malka Lorena Rae vs. Esti Ginzburg Juli Mery vs. Sofia Mechetner Israel vs. Ukraine Bar Refaeli vs. Yara Khmidan Neta Alchimister vs. Alina Kirchiu Yael Shelbia vs. Daria Vlasova

-

BELLAZON CUP OF NATIONS VI

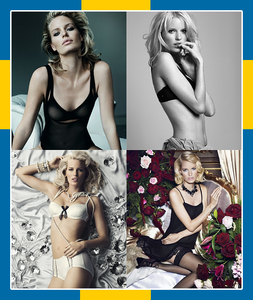

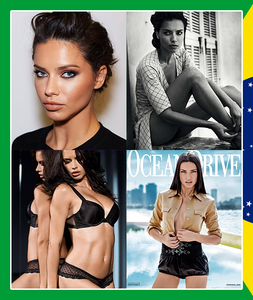

USA vs. Sweden [39.5 -30% = 27.65] Elizabeth Turner vs. Mona Johannesson [17.5] [23.5] Elizabeth Sawatzky vs. Hanna Edwinson [33.5] [36] Hailey Outland vs. Mathilda Bernmark [21] USA continues to fight another day Sweden has been eliminated ------------------ USA vs. Canada [37 -30% = 25.9] Taylor Hill vs. Celeste Desjardins [20 +30% = 26] [31] Carmella Rose vs. Michea Crawford [26] [30] Celine Farach vs. Marina Laswick [27] USA continues to fight another day Canada has been eliminated ------------------ Brazil vs. USA [40] Adriana Lima vs. Karlie Kloss [17] [14.5] Gracie Carvalho vs. Hannah Ferguson [42.5] [26.5] Gizele Oliveira vs. Caroline Kelley [30.5] USA continues to fight another day Brazil has been eliminated ------------------ Lithuania vs. Belarus [34] Gintare Sudziute vs. Katsia Zingarevich [23] [16.5] Julija Steponaviciute vs. Maryna Linchuk [40.5 -30% = 28.35] [21.5] Sima Jakuleviciute vs. Zhenya Katava [35.5] Belarus continues to fight another day Lithuania has been eliminated

-

BELLAZON CUP OF NATIONS VI

Voting is over....

-

What did you last buy!

I live exactly two blocks from another state so I'm always last on delivery routes. UPS & FedEx always deliver around 8pm for me.

-

What made you smile/laugh today?

- What did you last buy!

It's pretty easy actually.... First I go to google and in the search box I type the name of the store I'm interested in, I then search for items that I think the person might like, I pick out the size and color, then I hit add to basket.... Once I'm done shopping, I log into my account, or I make a new account if I've never shopped with them before. I then add all my info like Name/Address and then Debit or Credit card info and I hit submit to buy. Tada!- Valeria Rudenko

- Valeria Rudenko

- Taylor Hill

- Taylor Hill

- What did you last buy!

Screw birthdays, just another reminder of getting older I got more Christmas Gifts @Stormbringer - Lots of clothing for my mom... Paid off credit card, put money into savings, paid sewer and put extra money on electric/internet- BELLAZON CUP OF NATIONS VI

USA vs. Sweden Elizabeth Turner vs. Mona Johannesson 2.5x0.5 Elizabeth Sawatzky vs. Hanna Edwinson 2x1 Hailey Outland vs. Mathilda Bernmark 2x1 USA vs. Canada Taylor Hill vs. Celeste Desjardins 2x1 Carmella Rose vs. Michea Crawford 1x2 Celine Farach vs. Marina Laswick 1x2 Brazil vs. USA Adriana Lima vs. Karlie Kloss 1x2 Gracie Carvalho vs. Hannah Ferguson 3x0 Gizele Oliveira vs. Caroline Kelley 1x2 Lithuania vs. Belarus Gintare Sudziute vs. Katsia Zingarevich 0.5x2.5 Julija Steponaviciute vs. Maryna Linchuk 2x1 Sima Jakuleviciute vs. Zhenya Katava 1x2- BELLAZON CUP OF NATIONS VI

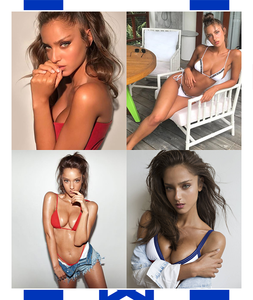

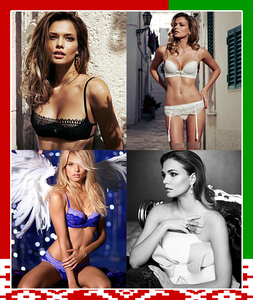

ELIMINATION ROUND *5* Click pictures for larger ROUND 1 USA 11 / Sweden 2 B - Elizabeth Turner - vs. - C - Mona Johannesson C - Elizabeth Sawatzky - vs. - C - Hanna Edwinson C - Hailey Outland - vs. - C - Mathilda Bernmark <-------------------------------------------> ROUND 2 USA 9 / Canada 1 A - Taylor Hill - vs. - C - Celeste Desjardins B - Carmella Rose - vs. - B - Michea Crawford C - Celine Farach - vs. - C - Marina Laswick <-------------------------------------------> ROUND 3 Brazil 2 / USA 1 A - Adriana Lima - vs. - A - Karlie Kloss B - Gracie Carvalho - vs. - B - Hannah Ferguson C - Gizele Oliveira - vs. - C - Caroline Kelley <-------------------------------------------> ROUND 4 Lithuania 2 / Belarus 1 C - Gintare Sudziute - vs. - C - Katsia Zingarevich C - Julija Steponaviciute - vs. - B - Maryna Linchuk C - Sima Jakuleviciute - vs. - C - Zhenya Katava Voting You have 3 points to spend per pairing. The team with the most points after any bonuses or handicaps moves on or goes into the Rep round. You may vote based on whatever criteria you want Maybe you hate the majority of the team but still want them to win because you like one model on the team - go for it Perhaps you don't know who the model is but find them attractive - that's fine too Lesser of two evils - IE. The Limer voter - have at it. Maybe you're just a super fan of a particular model - ect... Voting Template [Cut & Paste] USA vs. Sweden Elizabeth Turner vs. Mona Johannesson Elizabeth Sawatzky vs. Hanna Edwinson Hailey Outland vs. Mathilda Bernmark USA vs. Canada Taylor Hill vs. Celeste Desjardins Carmella Rose vs. Michea Crawford Celine Farach vs. Marina Laswick Brazil vs. USA Adriana Lima vs. Karlie Kloss Gracie Carvalho vs. Hannah Ferguson Gizele Oliveira vs. Caroline Kelley Lithuania vs. Belarus Gintare Sudziute vs. Katsia Zingarevich Julija Steponaviciute vs. Maryna Linchuk Sima Jakuleviciute vs. Zhenya Katava- Best Eyes Competition

1 3 5 8- Vika Bronova

.....- Taylor Hill

- Taylor Hill

- BELLAZON CUP OF NATIONS VI

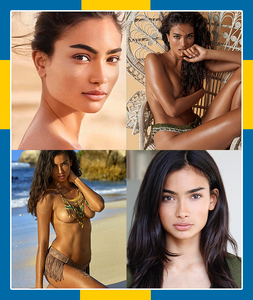

Sweden vs. USA [37] Kelly Gale vs. Lauren Layne [14] [16] Caroline Winberg vs. Madison Hope Headrick [35] [16] Emmy Rappe vs. Bridget Satterlee [35] USA continues on Sweden moves into the Rep Round ----------------- Ukraine vs. USA [19.3] Valeria Rudy vs. Elizabeth Turner [31.7 -30% = 22.19] [44.4] Vika Bronova vs. Elizabeth Sawatzky [6.6] [27.9] Nicole Nicoloa vs. Hailey Outland [23.9] Ukraine continues on USA moves into the Rep Round- BELLAZON CUP OF NATIONS VI

Voting is over...- Lauren Summer

Alright first off. STOP posting pictures with nudity without putting them in a spoiler. If I see it again I'm going to start handing out warnings. Get enough warnings and you'll be removed from the forum. Secondly. Enough of chow chow over the legality of pictures. Please don't worry about it. If the staff is contacted by Lauren, or someone from the industry we will handle it. There is simply no reason to keep going back and forth about something that frankly doesn't concern you till we have to step in for legal reasons. Just post pretty pictures. Thank you.- Admins: Please settle status of Patreon content

Thread locked till I figure out what's going on.- Lauren Summer

O.o... I'm locking this thread and cleaning it. I have no what's going on, but I'll be looking it into.- Taylor Hill

- BELLAZON CUP OF NATIONS VI

USA Ukraine vs. USA Valeria Rudy vs. Elizabeth Turner 2.4 x0.6 Vika Bronova vs. Elizabeth Sawatzky 2.4 x0.6 Nicole Nicoloa vs. Hailey Outland 2.4 x0.6- BELLAZON CUP OF NATIONS VI

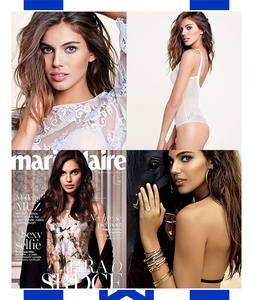

WINNERS ROUND *5* Click pictures for larger ROUND 3 Sweden 3 / USA 8 C - Kelly Gale - vs. - C - Lauren Layne C - Caroline Winberg - vs. - C - Madison Hope Headrick C - Emmy Rappe - vs. - C - Bridget Satterlee <-------------------------------------------> ROUND 4 Ukraine 1 / USA 11 C - Valeria Rudy - vs. - B - Elizabeth Turner C - Vika Bronova - vs. - C - Elizabeth Sawatzky C - Nicole Nicoloa - vs. - C - Hailey Outland Voting You have 3 points to spend per pairing. The team with the most points after any bonuses or handicaps moves on or goes into the Rep round. You may vote based on whatever criteria you want Maybe you hate the majority of the team but still want them to win because you like one model on the team - go for it Perhaps you don't know who the model is but find them attractive - that's fine too Lesser of two evils - IE. The Limer voter - have at it. Maybe you're just a super fan of a particular model - ect... Voting Template [Cut & Paste] Sweden vs. USA Kelly Gale vs. Lauren Layne Caroline Winberg vs. Madison Hope Headrick Emmy Rappe vs. Bridget Satterlee Ukraine vs. USA Valeria Rudy vs. Elizabeth Turner Vika Bronova vs. Elizabeth Sawatzky Nicole Nicoloa vs. Hailey Outland - What did you last buy!

Account

Navigation

Search

Configure browser push notifications

Chrome (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions → Notifications.

- Adjust your preference.

Chrome (Desktop)

- Click the padlock icon in the address bar.

- Select Site settings.

- Find Notifications and adjust your preference.

Safari (iOS 16.4+)

- Ensure the site is installed via Add to Home Screen.

- Open Settings App → Notifications.

- Find your app name and adjust your preference.

Safari (macOS)

- Go to Safari → Preferences.

- Click the Websites tab.

- Select Notifications in the sidebar.

- Find this website and adjust your preference.

Edge (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions.

- Find Notifications and adjust your preference.

Edge (Desktop)

- Click the padlock icon in the address bar.

- Click Permissions for this site.

- Find Notifications and adjust your preference.

Firefox (Android)

- Go to Settings → Site permissions.

- Tap Notifications.

- Find this site in the list and adjust your preference.

Firefox (Desktop)

- Open Firefox Settings.

- Search for Notifications.

- Find this site in the list and adjust your preference.